The missing piece from the economic recovery has finally materialized. Median household income, adjusted for inflation, is now higher than it was before the recession that began at the end of 2007, according to new data published by Sentier Research. –Yahoo

So incomes are rising again. Presumably, this is supposed to mean that the “recovery” is becoming stronger in the US.

This economic propaganda comes in so many flavors that people may just surrender and accept what the media says. But they shouldn’t.

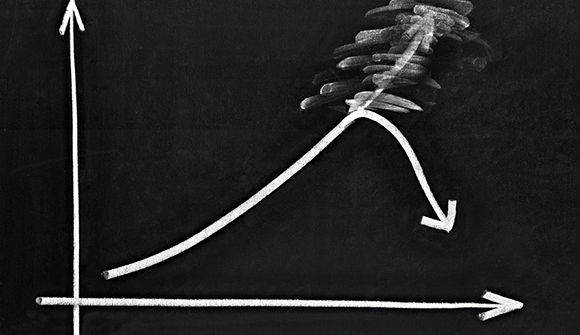

Incredibly, we have a system that seeks to create prosperity by fixing the price and volume of money. The idea is for central banks to keep printing money until the economy is properly “stimulated.”

It doesn’t work.

What is being left out of articles like the Yahoo story, above, is that monetary stimulation creates a sensation of economic progress but not the reality.

Monetary stimulation forces an overabundance of money (credit really) into places that are receptive to such money.

These places are speculative – real estate, the stock market, the art market, etc. They can absorb a lot of cash.

Credit flows much more slowly to the mainstream industrial sector. Thus central banking money printing tends to inflate speculative markets first. These, of course, become “asset bubbles.”

Eventually, the money spills out of asset bubbles into the larger economy and industrial activity tends to pick up.

As industrial activity picks up, the overabundance of money flows through the consumer sector as well.

People begin to believe, wrongly, that their employment seems a bit more secure and take advantage of the money coursing through the consumer economy to make purchases and take out loans.

All this happens toward the end of the cycle, though of course there are no hard and fast timelines.

Consumer speculation is surely a warning that a particular central-bank business cycle is reaching its conclusion.

Observing the mainstream media, we can see the warnings.

For instance, in late February, USA Today reported that “subprime auto loan delinquencies hit six-year high.”

This is certainly a resonant statistic given that subprime real estate helped trigger the massive crash of 2007-2008.

Subprime real estate is far less leveraged today than it was in the mid 2000s. But credit, like water, finds its own level during a sustained episode of money printing. And now the subprime auto-loan sector is inflating.

It’s been estimated that central banks have printed some US$100-200 trillion (no one really knows) in the past five or six years to shore up the current dysfunctional financial system.

Exposed to torrent of available money and credit, consumers are taking advantage to buy things they want or need but couldn’t usually afford.

We will see how long it lasts.

Reuters provides us another warning sign in a recent article entitled, “Home ‘flipping’ exceeds peaks in some hot U.S. housing markets.”

Here’s how it begins:

Home flipping – buying and reselling a home to make a quick buck – has risen in some hot U.S. housing markets, prompting concerns that local housing bubbles could be developing, according to a report published on Thursday.

The report by RealtyTrac found that home flipping in 12 active metropolitan areas last year was above a peak set in 2005, just two years before the U.S. mortgage market started to collapse, leading to a banking crisis and the Great Recession.

This kind of fervid real-estate speculation is another sign of economic overheating.

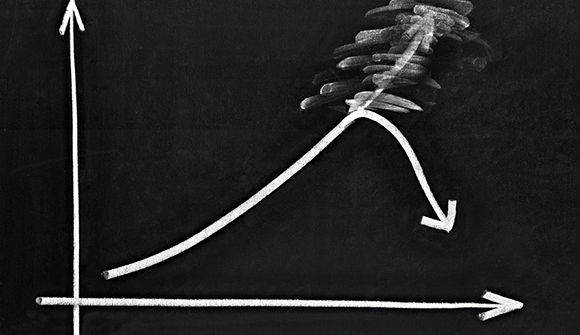

Nothing changes when it comes to central banking economies. The system seems deliberately designed to impoverish middle classes and, eventually, to cause whole countries to collapse.

The fundamental mechanism of central banking is price fixing of money (credit-based currency). Price fixing creates enormous, destructive distortions whenever it is tried and “money” is no exception.

Free-market economists are well aware that economies may rise or fall slightly depending on the level of activity. But the modern business cycle is to a free-market one what a tsunami is to a mild tide.

Just look at Brazil, which was the subject of worshipful business profiles throughout the first decade of the 2000s.

At the time, Brazil seemed to be making tremendous progress industrially but of course the real driving force of the economy was money printing.

And what has happened to Brazil? Here from Germany’s Deutsche Welle:

Brazil headed for worst recession in a century … Latin America’s biggest economy has reported its steepest annual decline in gross domestic product (GDP) since 1990, setting the country on course for its worst recession in at least a century.

According to government figures released Thursday, Brazil’s economy contracted by 3.8 percent in 2015 – the biggest annual fall since a 4.3-percent dip reported some 25 years ago.

Central bank economies are all subject to this sort of economic reversal to a greater or lesser degree, depending on the volume of circulating money and the timeline of its availability.

In the West, it has taken an enormous circulation of money to counteract what would otherwise have been a catastrophic descent into a powerful but brief depression.

By printing their tens and hundreds of trillions, central bankers have prolonged the pain and created an ongoing Great Recession that has lasted more than a half decade already.

It is very possible, as we have written, that the upcoming years will see an enormous struggle with “stagflation.” Asset classes will rise and fall against a backdrop of mounting price inflation as tens of trillions begin to circulate with more velocity.

This last happened in the 1970s but the crisis is so much more severe today and the amounts of currency in play are at this point beyond human comprehension.

The derivatives market alone is estimated to be in the area of one thousand trillion dollars.

Conclusion: Don’t fall into the trap of believing in a “recovery” in the US or the West. It’s just more mainstream (central banking) propaganda. Expect prices to climb, perhaps aggressively, and people to continue to struggle – perhaps to just survive. Please plan accordingly.