"Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years." ~ Warren Buffett (taken from a list of "50 Warren Buffett Quotes to Inspire Your Investing," Michael Cramton of investinganswers.com, March 15, 2011)

Scott Schamber, Dirk Steinhoff and I just got back from a very interesting and educational trip to the US where we held three of our BFI Inner Circle Briefings. The first stop on the Briefings tour took us to Austin, Texas, and then on to two additional stops in California: one in Santa Barbara and another in Berkeley. It was very insightful, a great learning experience and also a lot of fun − hopefully for the attendees of our Briefings as much as it was for us.

What we tried to do differently this time around with these Briefings was to tailor the program entirely to the immediate interests and concerns of our attendees. With that in mind, we spent a great deal of time more on questions and answers than we have in our past Briefings. I just want briefly share some of the insights and conclusions drawn from the Briefings and personal meetings we had with some roughly 130 clients, contacts, and old friends during these past two weeks.

An excellent gauge of the concerns of all of our readers/clients

Our Briefings were held at an undoubtedly interesting time. We have the upcoming presidential elections in America. Ben Bernanke has followed Draghi's QE lead and trumped with his promise of 'QE forever' (why even number them anymore?). Meanwhile, in Germany, the courts decided that Draghi's monetary policy, despite a clear contradiction to the EU's laws and Germany's own constitution, is still perfectly legal.

Quantitative easing (QE) is today's central bankers' panacea for stimulating the economy. While clearly having boosted the stock market, QE has not helped boost employment enough. The model of running inflation higher than interest rates for an extended period, in an effort to reduce government debt loads in real terms, is their primary plan. It helps to paper over the problems in a credit-addicted economy.

In that context, when it came to the Big Picture discussions at our Briefings, a few topics really stood out. Amongst those topics were (1) the outlook for international currencies: the Euro, the Swiss franc and, of course, the US dollar, (2) the prospects of more financial repression and its implications for investors and citizens and then, of course, (3) the impact of monetary inflation and global quantitative easing (currently, the most prominent of financial repression measures).

Once we had covered the big picture thoroughly, much of our time was then focused on adequate solutions and strategies. Of the questions our attendees had, many centered around, first, international asset protection and planning strategies, including legal structures such as offshore LLCs and trusts, as well as international private placement life insurance planning. Secondly, a lot of questions related to recent regulatory changes, in particular US reporting rules (the FBAR and Shadow FBAR), as well as the implications of FATCA. Finally, we spent considerable time discussing asset allocation, including the recent upturn in markets across the board, as well as the proper ownership of gold and silver in light of the current realities.

Many questions, multiple concerns, and a few conclusions

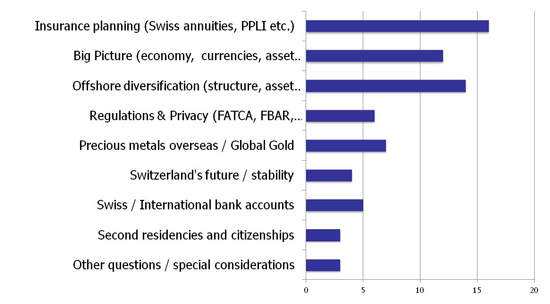

Using a pre-Briefing questionnaire, something we had never done before, the following graph provides a sample and statistical summary of the questions that we received prior to the Santa Barbara Briefing. The concerns expressed by the Santa Barbara group were relatively the same for the other two Briefings, with the weightings to some subjects being the only variation amongst the groups. It certainly set up for a very interesting and interactive dialogue.

Personally, one conclusion that I came away with was that our clients and Mountain Vision readers were already fully alerted and fully aware of the ramifications of current monetary and fiscal imbalances.

They were completely cognizant of the specter of financial repression and its most prominent representative today: quantitative easing. And they understood that a few elements were critical in managing the risks: (1) jurisdictional diversification and the asset protection, safety and flexibility that goes with it, (2) active and smart risk management at all levels and (3) gold, physically allocated in particular, should serve as a favored allocation, making up at least 20% to 30% of their investment portfolios. We have some very smart, very wealthy and very successful clients.

May the election games begin!

There was also a high level of anxiety amongst the attendees as to the potential outcome of the November presidential elections. Clearly, many at the Briefings were highly concerned with the somewhat "unsatisfactory choices" the American voters are being served. But at the same time they were also unilaterally opposed to granting President Obama another term. The tenor was very clear: he had his chance and he failed. With Obama, their expectations are dismal: higher taxes, more financial repression, less freedom and no hope for a stronger economy.

It was widely recognized that, while there is so much at stake, the election appears to have become something of a theatrical farce. Many Americans appear to be disappointed. The media, of course, is covering it ALL, focusing in on the most critical issues America must consider: from Michelle's dress to Romney's stumbles. Quite a few people I talked to appeared resigned to the circus, poking fun at the media show the presidential election is turning into.

On a more serious note, and at least until the presidential elections, we expect financial markets to perform quite well. There are still quite a few stocks that are undervalued and will outperform in the current mix of reflationary measures worldwide. Mining shares also look interesting. We expect gold and silver to continue their upward trend.

Gold in particular is going to continue to benefit from QE and from the fact that bankers worldwide are suddenly looking more favorably upon the metal. Believe it or not, Deutsche Bank has now gone on record predicting $2,000/ozt by the end of the year. That's new!

As for the US elections, may the best man, and his wife, win!

LAST CALL BEFORE US$ 2,000! A FEW CONSIDERATIONS ON THE PROSPECTS OF GOLD − AND GOLD CONFISCATION

As I write this, the price of gold has risen back to US$ 1,775 per troy ounce. The bull market trend has been, once again, forcefully confirmed. It is alive and well both technically and fundamentally. Until the root problems of the global fiat currency and banking system are addressed and solved sustainably, I expect this trend to go on.

However, what has occurred in gold markets over the past few weeks is not merely a continuation of the same. I observed a change in tides of the speech and actions of the very market participants that have vociferously denigrated the status and opposed the advance of the price of gold over the past decades − namely central bankers, large commercial banks, government officials and the mainstream press.

Recent developments might be compared with the proverbial cracks in the dam. Things are starting to move in favor of gold prices, and rapidly.

The game-changer: banks are starting to love gold!

A few weeks back we wrote about the fact that central banks have globally turned into the largest net buyers of gold since 2011, despite a continuance of the generally negative rhetoric of their most prominent figureheads. We also highlighted the fact that, in the realm of Basel III, gold is to become a "Tier 1 asset." In other words, gold is to be treated as a "zero percent risk-weighted item," next to such items as cash, US Treasury papers or IMF claims.

This clearly indicates another considerable catalyst for the price of gold. The impact is already trickling down. Last week, Deutsche Bank Research, for instance, issued an amazingly gold-friendly research paper. Here's a sample of what they had to say:

"We believe there are nearly zero real options available to global policy-makers. The world needs growth and is willing to go to extraordinary lengths to get it. This is creating distortions where old rules don't seem to apply and where investors face a number of paradoxes. We believe the macro-economic environment for gold is once again turning more positive and forecast prices to exceed USD 2,000/oz in the first half of 2013. We believe the growth in supply of fiat currencies such as the USD will remain an important driver."

It almost makes us blush to see how much their point of view has changed and how it suddenly resembles what we've been saying for quite some time. Take a look for yourself. We are unashamed, although a little surprised, to say that we agree entirely!

What is the greatest threat to your gold ownership?

A question that I am asked again and again is if our government will confiscate gold. This question is being asked from Berlin, to Beijing, to Washington DC. It is a good question. We are currently observing a change in tide on how central bankers and bankers in general view gold. The days of shunning the metal as a "useless relic of the past" appear numbered.

The recent special report by Deutsche Bank Research has made some waves in this regard. Meanwhile, Jens Weidmann, head of Germany's Bundesbank, has called Mario Draghi's bond buying program the "devil's work." Clearly, a change of perspective is permeating through the mainstream and government speaks.

It is, therefore, quite logical to raise the aforementioned question again of whether or not gold will be confiscated. This question came up quite a bit at our Briefings in the US, as well. The question echoes another question that was posed: "How far will governments go to defend the status quo?"

The answer to both questions is best stated with two words: CONSULT HISTORY! Governments have gone and will go far again. They have confiscated and may confiscate again. Nobody has a crystal ball. However, the risk of confiscatory policies in the current context of unprecedented debt levels − and the government measures that come with it, namely financial repression, inflation, austerity, default − are very real. You need to consider this risk in your wealth planning. Clearly, geographic diversification is a critical piece of the strategy required.

Instead of re-inventing the wheel on this topic, I would like to refer you to an excellent article written by Jeff Thomas and published by International Man. It's titled "The Greatest Threat to Gold Ownership." The article is certainly worth your time and consideration, if for nothing else than to at least spark a discussion on a very timely and potentially important subject.

It is time to stock up on gold, but to own it the RIGHT WAY

If you have not allocated a considerable part of your portfolio toward gold, this is the time to seriously consider… or reconsider.

If you own paper gold − ETFs, claim accounts, fractional digital accounts and the like − you need to consider adjusting your ownership. Paper gold will not give you the protection you seek. It will not allow you to fully profit from this once-in-a-lifetime bull market. The fact is that nobody will be interested in paper gold as we see gold prices rise further and supplies of 'the real deal' become scarce.

If you own physically allocated precious metals − gold and silver coins and bars − you are on the right track. In addition, you must ask yourself whether you are concerned about gold confiscation in your home country. If you are, I strongly recommend you consider a program that affords physically allocated gold ownership in a safe jurisdiction.