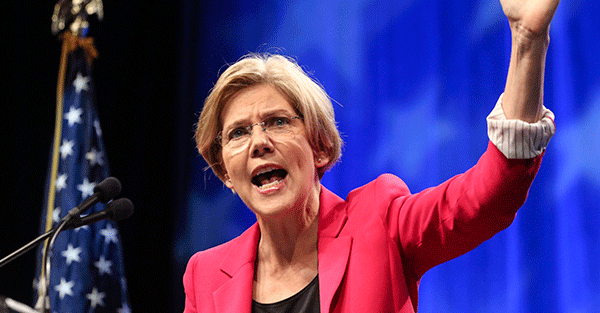

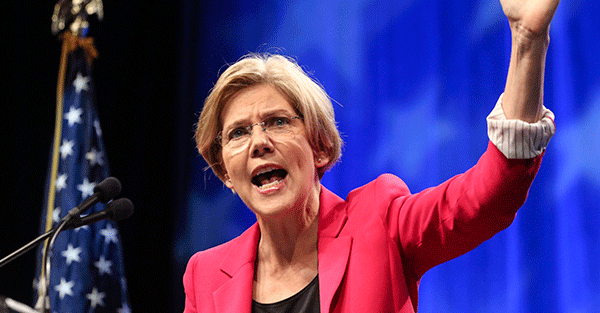

Elizabeth Warren, the Senator from Massachusetts, is full of great ideas.

Her image of the perfect world is one of nonstop government regulation. All business must be controlled… by her, of course.

Only an ex-professor knows best how the 330+ million person American economy should function!

Warren’s first brainchild was the Consumer Financial Protection Bureau (CFPB). President Obama signed the agency into law in the wake of the 2008 financial crisis, with the mission to “protect” consumers from unfair, deceptive, and abusive practices by big business.

Yet this is an agency that itself is so unfair, deceptive, and abusive that it was sanctioned by a federal judge for its unethical actions earlier this year.

In short, the judge said that the CFPB was indiscriminately bullying a private company. When it ordered them to cease and desist, the CFPB then showed “blatant” and “willful” disregard for the judge’s instructions.

Like the CDC, and many other federal agencies for that matter, the CFPB has become highly ideological. Fanatical really. And they’re far more likely to assault businesses that don’t bend the knee to the political left.

It sounds like there needs to be a government agency to protect businesses from the CFPB.

The larger issue, of course, is that the CFPB (which has now been around for more than a decade) is yet another agency that creates rules and regulations… each of which has a cost.

Regulations aren’t free. Businesses and individuals have to take time and often spend money to comply… time and money that could be better spent on productive activities.

The CFPB also costs taxpayers money. The CFPB, in fact, has been under fire for spending lavishly (nearly 3x over budget) to renovate its headquarters building, which comes with a fancy waterfall.

What exactly is the benefit of this agency? How are taxpayers better off?

For most people, the answer is “not at all”. I doubt you jump out of bed in the morning thanking your lucky stars that the CFPB is there to protect you.

Yet despite its dubious benefit, the CFPB’s cost to taxpayers… and to the US economy… is substantial.

But naturally they never learn from their mistakes. And so Elizabeth Warren is back with another great idea that taxpayers can foot the bill for.

Her new bill, the Digital Platform Commission Act of 2023, would establish a Federal Digital Platform Commission with the power “to regulate access to, competition among, and consumer protections for digital platforms”.

Perfect. For Elizabeth Warren, it’s not enough to create more regulations. She wants to create more regulatory AGENCIES… including a special commission where bureaucrats and politicians can tell websites how to design their layouts.

Don’t get me wrong, I have no love for the Big Tech and social media companies. I think Mark Zuckerberg has had a major role in f’ing up the world… and I’ve said before that if he chased children around in real life with the same perversion as he watches them online, he’d probably be in jail next to Jared from Subway.

But a new agency to regulate ALL online businesses will be yet another bureaucracy with no benefit to average guy.

It’s not like there aren’t enough regulations now. The Code of Federal Regulations is nearly 200,000 pages at this point.

Yet somehow, anytime something goes wrong, the solution is not just more regulations, but more regulatory agencies!

That means that people who could be doing something productive in the private sector are now in government agencies making it more difficult and expensive to do business.

Again, this all comes at a cost. Regulations are expensive in that they require taxpayer funds, plus time, money, and energy for businesses to comply. The consequence is that excess regulations make the economy less productive… and America cannot afford to be less productive right now.

We’ve talked about this before: economic productivity is THE solution to America’s problems.

Real GDP growth since 2000 has averaged just 2%.

Back in the 1980s and 1990s it was 3.3%. And it turns out that the 1.3% difference in growth has an enormous impact.

If real US economic growth had remained at 3.3% for the past 20 years, most of the US financial problems would have already melted away.

Tax revenue would have grown so much that budget deficits would be non-existent. America’s debt-to-GDP ratio today would be less than 50%, and falling (instead of > 120% and rising).

At sustained 3.3% growth, in fact, the national debt would hit zero by 2033. Social Security would be completely funded. The US would have no financial challenges whatsoever. And the US dollar’s dominance would be unquestioned.

The US government could even spend to its heart’s content on every fanatical woke idea they could think of… simply because the economy would be so strong and productive.

And it’s not like an additional 1.3% growth isn’t achievable. Again, the US achieved this in the 1980s and 1990s.

You’d think that, in the face of such obvious historical data, politicians would do everything in their power to maximize productivity. They’d embrace capitalism, cut red tape, create incentives for production, support small businesses, make taxes more efficient, etc.

Or at a minimum, they’d simply stay out of the way.

But instead, they do the exact opposite. They consistently create new regulations and roadblocks to productivity… just like Elizabeth Warren’s stupid new idea.

Now, it’s not like this ONE new agency is going to wreck the economy or send the US over edge.

In fact, America’s financial woes are still fixable if they start doing the right things.

But think about the financial health of a nation like our individual, physical health.

No one has a heart attack from one french fry. But a lifetime of french fries causes serious health problems. At a certain point, you just have to put down the McDonalds and start making healthy decisions.

But they can’t manage to do that. Elizabeth Warren seems to think that french fries are healthy, and she’s blind to the consequences of her horrendous ideas.

Which is why we write so much about having a Plan B. The people in charge just don’t understand. Every day they come up with more destructive ideas that make the economy weaker and create more long-term problems.

A great Plan B reduces your exposure to the risks they create. It includes things like diversifying your savings into other currencies and other assets that they don’t control.

And, yes, it even means having another place to go if you ever really need it.

Want more articles like this? Sign up here to receive Sovereign Man letters to your email.