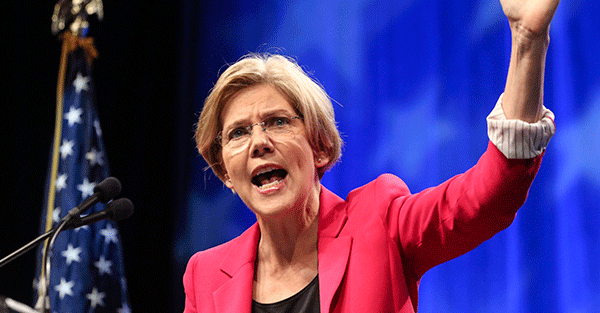

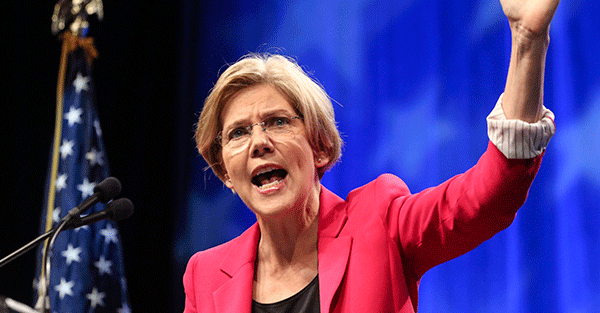

Elizabeth Warren Is Good at Her Job … Elizabeth Warren has a rare talent for distilling political messages. In 2011, as she was running for the Senate seat that she won the next year, the former Harvard law professor delivered the kind of concise, pointed rationale for public investment — and the taxation to support it — that the White House had been striving to master for the previous three years. -Bloomberg

This Bloomberg editorial celebrates Elizabeth Warren’s famous justification of taxes and the federal government.

It tells the story of how the left wing Senator from Massachusetts was filmed in a “crude video” explaining her positions in a supporter’s house. “Her remarks have since been viewed more than a million times.”

She spoke to a made-up individual who had started a successful company but believed his taxes were too high.

“You moved your goods to market on roads the rest of us paid for. You hired workers the rest of us paid to educate. You were safe in your factory because of police forces and fire forces that the rest of us paid for.

Now, look, you built a factory and it turned into something terrific, or a great idea. God bless — keep a big hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.

This was such a successful justification for progressive taxation that when he accepted the presidential nomination in 2102, Barack Obama made similar points.

“As colloquial political philosophy goes, Warren’s address made as good a case for the liberal social contract as you’re likely to hear.”

The trouble with Warren’s points is that the anecdote is a fiction not just in terms of its reality but also in terms of its tone and substance.

Her presentation seems to imply that there was some level of discussion about taxes.

There is no discussion.

The IRS is not going to take the time or energy to justify taxation to you and neither is a Senator.

You need to pay what you owe.

So long as you pay, you can ask questions. But if you do, you may end up on a government list identifying “terrorists.”

You could maintain for instance that a contract is something entered into voluntarily but you had no choice in the matter.

You could also point out that the federal government does a terrible job of educating students.

A Frontpage Magazine article pointed out in 2013 that New York City spent some $20,000 educating students that still couldn’t read nor write when they reached college.

Nearly 80 percent of New York City high school graduates need to relearn basic skills before they can enter the City University’s community college system.

Presumably it’s no better today.

Warren mentions the roads that the factory owner uses. But public infrastructure in the US is a mess.

Estimates are that it will take something like $4 trillion to fix the US’s aging infrastructure, including roads, bridges, sewers and water delivery.

Government passes initial programs because they are popular and help politicians gain votes. But ongoing maintenance is often expensive and lacks a political payoff.

For this reason, privately funded infrastructure may be a good deal more practical than public programs. Unfortunately, throughout the West, public infrastructure is the preferred alternative.

The result: Flint Michigan just poisoned its citizens with lead content in drinking water and tried to cover it up.

Public maintenance of any good or service is questionable in the long term. The competitive and customer-oriented incentives simply don’t exist in the public sector.

For instance, Warren makes the case that the factory owner was safe at home and at work because the police were protecting him.

But these days, government officials increasingly see civil policing, along with other publicly funded, armed entities, as providing protection to bureaucratic environments.

The Pentagon and Homeland Security have been busily arming police with the latest military equipment. Last year alone, police killed at least 1,100 citizens according various public sources.

Warren assumes the success of the factory owner, but regulations, taxes and central bank monetary debasement have all take their toll on business startups.

These still occur in the US but according to Reason magazine, entrepreneurial activity has been shrinking in the US since 2008.

While startups occur in urban environments, business in less populated areas has fallen off significantly.

The trouble with Warren’s statement is that it is loaded with assumptions about the relationship between fedgov and its citizens.

It presents a social contract that does not exist.

US fedgov is actively hostile to its citizens. At any one time there are some six million in various stages of incarceration in the US. And those in prisons can be legally treated as slave labor.

USA Today once carried a report that one of every three US citizens had some sort of criminal-oriented interaction with police before the age of 25.

Homeland Security identifies many types of Americans as “terrorists” these days, including those who believe in a constitutional republic.

The country’s many intelligence agencies and domestic spying systems unconstitutionally target citizens without warrants or even reasons.

It is fairly clear that fedgov and the Pentagon are actively anticipating citizen violence over the next few years as the economy continues to unravel.

What is never mentioned is that the entire system has been positioned to fail.

Only failure provides the West’s elite leadership with the justification to rebuild – this time on an international rather than national scale.

This is something to keep in mind when contemplating whether the US or the West itself can return to a more productive and prosperous past. The West’s leaders don’t want to.

Conclusion: Warren’s assumption that a social contract exists between citizens and their governments is faulty. Her argument in this day-and-age is make believe.